Blog

25/10/2025

WHAT SHOULD BUSINESSES PREPARE FOR THE UPGRADE PROCESS?

Following the engaging discussions on the topic “The Market Story of September” from the Directors...

Xem thêm19/10/2025

DIRECTORS TALK #24 SEMINAR – WHEN CORPORATE GOVERNANCE BECOMES THE KEY TO ATTRACTING FOREIGN CAPITAL

On September 25, 2025, VIOD successfully organized the Directors Talk #24: “Market Story in September”,...

Xem thêm29/09/2025

Understanding Trade Agreements and Common Law – The Key to Unlocking Global Growth for Vietnamese Enterprises

International Speakers & Legal Experts Converge at the HCMC Business Summit 2025 On 25 September...

Xem thêm06/09/2025

Roundtable Discussion on the Draft Political Report of the Ho Chi Minh City Party Congress

On the morning of September 6, 2025, the Ho Chi Minh City Women’s Union organized...

Xem thêm27/07/2025

Visiting and Gift Giving at Vinh Son Nursing Home

On the morning of July 12, 2025, the Ho Chi Minh City Association of Women...

Xem thêm19/06/2025

Scientific Workshop on reviewing, evaluating, and adjusting the undergraduate law training program

On June 3, 2025, at the Scientific Workshop on reviewing, evaluating, and adjusting the undergraduate...

Xem thêm09/04/2025

Sharing at the 30th Independent Board Member Certification Program

On March 03, 2025, at the 30th Independent Board Member Certification Program (DCP) organized by...

Xem thêm09/04/2025

KALF was honored to receive a Certificate of Merit from the Ho Chi Minh City Young Business Association

On February 23, 2025, during the 2024 activity summary program of the Ho Chi Minh...

Xem thêm08/01/2025

M&A in businesses today

What is M&A? M&A is an abbreviation of the English phrase: Mergers and Acquisitions. M&A is...

Xem thêm08/01/2025

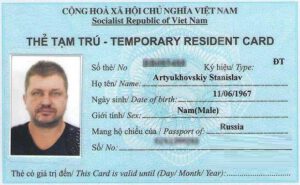

Issues related to temporary residence for foreign investors

With the open door policies, calling for FDI with many incentives of the Vietnamese government...

Xem thêm02/01/2025

Certificate from the Ho Chi Minh City Business Association

On December 11, 2024, during the year-end summary program of the Ho Chi Minh City...

Xem thêm02/01/2025

Legal sharing for Board of Directors members

On November 22, 2024, at the DCP Program of the 30th Cohort organized by the...

Xem thêm